Simple Info About How To Become A Mortgage Broker In Australia

Certificate iv in finance & mortgage broking (minimum requirement) diploma in finance &.

How to become a mortgage broker in australia. In order to become a mortgage broker, you will need to have at least a bachelor’s degree in finance or a related field. How to become a mortgage broker in australia step 1: Barring any unforeseen delays, after 28 days asic will issue you with your.

It should be noted that this is a minimum requirement to practice and that registration with fbaa (finance brokers association of australia) has this listed as the minimum level of education. Something to keep in mind as you learn how to become a mortgage broker in australia is that these remunerations aren’t a consistent mortgage broker salary. Clear credit history (minor exceptions can be made).

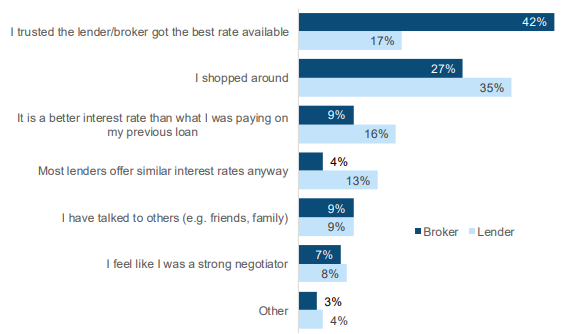

1first, we’ll get to know you. Mortgage brokers settle around 60% of all home loans. Aggregators can appoint you as a credit representative under their australian credit license, give you access to a panel of lenders, provide you with business.

When becoming a mortgage broker, you must complete a certificate iv in finance and mortgage broking. Become a mortgage broker in 4 steps. The certificate iv in finance and.

2 start thinking about your new business and. Become a mortgage broker in 7 steps: The person, who has completed just high school, can join mortgage broker course.

In australia, mortgage brokers must have a certificate iv in finance and mortgage broking from an accredited training provider, as well as professional indemnity insurance. Market share of australia’s $686.93 billion home loan market grew by 7.3% in 2019. How to become a mortgage broker.